In retail, COAs often segregate accounts for inventory, sales, cost of goods sold (COGS), and various expense categories. For instance, a retail Chart of Accounts might have detailed sub-accounts for different product lines or departments. It helps track sales revenues, inventory levels, and specific expenses like advertising, rent, or utilities. To wrap it up, the COA is crucial for businesses to handle their money matters. It helps organize financial information into different categories, like what the company owns, what it owes, and where it gets money from.

Where to find assets in a financial statement?

Expense accounts allow you to keep track of money that you no longer have, and represents any money that you’ve spent. For example, if you rent, the money will move from your cash account to a rent expense account. They represent what’s left of the business after you subtract all your company’s liabilities from its assets. They basically measure how valuable the company is to its owner or shareholders. It’s not always fun seeing a straightforward list of everything you spend your hard-earned money on, but the chart of accounts can give you an important view of your spending habits. You can get a handle on your necessary recurring expenses, like rent, utilities, and internet.

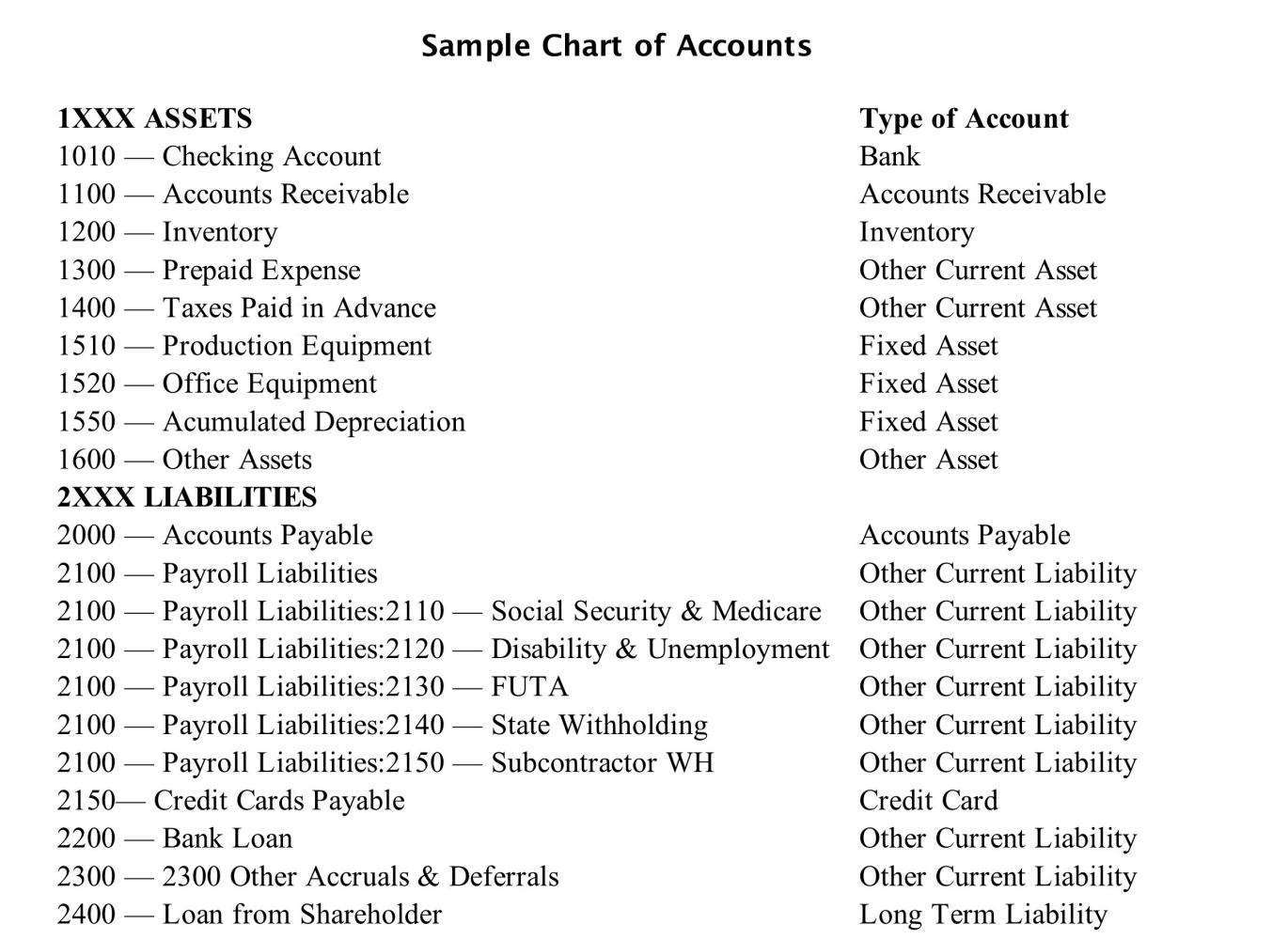

Chart of Accounts examples:

By doing so, you can easily understand what products or services are generating the most revenue in your business. If you create too many categories in your chart of account, you can make your entire financial reports difficult to read and analyze. To create a COA for your own business, you will want to begin with the assets, labeling them with their own unique number, starting with a 1 and putting all entries in list form. The balance sheet accounts (asset, liability, and equity) come first, followed by the income statement accounts (revenue and expense accounts).

- For example, companies in the United States must have certain accounts in place to comply with the tax reporting requirements of the IRS (Internal Revenue Service).

- But experience has shown that the most common format organizes information by individual account and assigns each account a code and description.

- Consider integrating it with all your sales sources and payment systems to create a single source of truth about your business finances.

- Meanwhile, let’s look at the general ledger real quick because general ledger uses the accounts listed in the chart of accounts to record and organize financial transactions.

Chart of Accounts: Definition, Guide and Examples

These can include cash, inventory, equipment, buildings, and investments. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. For example, many accounts that are essential in manufacturing are not commonly used by retail businesses, including the composition of cost of goods sold (COGS). Since different types of entities use different types of accounts, there is no one single chart of accounts template that would be applicable to all businesses. Before recording transactions into the journal, we should first know what accounts to use.

Flexibility for Future Modifications:

They can vary, but the most typical here are the COGS, gains and losses, and other comprehensive income accounts. Revenue appears at the top line of the income statement, showing the total amount of money earned from sales or other business activities. It reflects the company’s ability to generate income from its core operations, indicating its financial health and growth potential. As mentioned above, equity is one of the so-called balance sheet accounts, as it appears in the balance sheet. Equity is listed alongside liabilities, representing the shareholders’ stake in the company’s assets.

The remaining revenue and expenses accounts fall into the profit and loss accounts, as they appear in this financial statement. The COA is usually hierarchical, with accounts organized in categories and subcategories. These categories include assets, liabilities, equity, revenue, and expenses.

A chart of accounts organizes your finances into a streamlined system of numbered accounts. You can customize your COA so that the structure reflects the specific needs of your business. The chart of accounts serves as the backbone for accurate financial reporting, compliance with accounting standards, and efficient financial management. By categorizing every transaction a business undertakes, the COA ensures that financial statements accurately reflect the company’s true financial position. Asset, liability and equity accounts are generally listed first in a COA. These are used to generate the balance sheet, which conveys the business’s financial health at that point in time and whether or not it owes money.

Having a Chart of Accounts allows businesses to easily track their financial transactions, generate meaningful financial reports, and maintain compliance with applicable regulations. It also ensures consistency in the way expenses are reported and simplifies bookkeeping tasks. business software explained Also, accounting software packages tend to come with a set of predefined charts of accounts for different types of businesses in variety of industry sectors. The Chart of Accounts is one of those unknown parts of your accounting software we don’t even think about.

A general ledger stores a detailed record of a company’s financial activities, facilitating the preparation of financial statements and performance analysis. Meanwhile, let’s look at the general ledger real quick because general ledger uses the accounts listed in the chart of accounts to record and organize financial transactions. The chart of accounts, at this point, serves as a structure under which the general ledger operates.

You can also examine your other expenses and see where you may be able to cut down on costs if needed. Assets are resources your business owns that can be converted into cash and therefore have a monetary value. Examples of assets include your accounts receivable, loan receivables and physical assets like vehicles, property, and equipment. For instance, if you rent, the money moves from your cash account to the rent expense account. Expense accounts allow you to keep track of money that you no longer have. If you don’t leave gaps in between each number, you won’t be able to add new accounts in the right order.